Retirement Reset

3 minute read

The Alliance for Lifetime Income three times conducted a nationwide survey of people in their prime retirement years – ages 61 to 65 – to better understand the questions, lessons and surprises that arise for so many as they approach the end of their career. The survey also provided useful insights into how Americans at this age respond to heightened uncertainty and think about the timing of their own retirement.

Retirement Reset Wave 1 – April 9, 2019

The Alliance for Lifetime Income’s first Retirement Reset study found that nine in ten (91%) employed Americans in their prime retirement years anticipate their retirement timing will be based on hitting specific planned milestones. Yet, nearly half (47%) of those in the same age range who have already retired say they did so as the result of circumstances not fully within their own control.

Retirement Reset Wave 2 – may 19, 2020

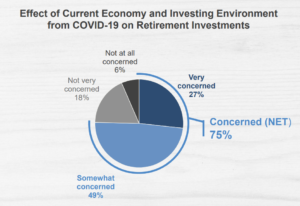

The Alliance for Lifetime Income’s second Retirement Reset study found one in four Americans say they have a lower risk tolerance for future retirement investments because of the COVID-19 pandemic. The crisis has also prompted 16 percent of respondents to consider the benefits of protected lifetime income that an annuity or pension provide – an indication that Americans are shifting towards investments that offer protection from market volatility. Three out of four respondents are concerned about the pandemic’s impact on retirement investments.

Retirement Reset Wave 3 – July 29, 2020

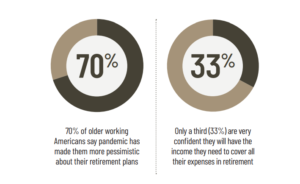

The Alliance for Lifetime Income’s third Retirement Reset study found Americans are approaching retirement with a deepening crisis of confidence and increasingly looking for ways to protect their retirement income. A staggering seven-out-of-ten respondents (70%) – some of the more affluent retirement savers in the country – report that the pandemic has made them more pessimistic about their retirement plans. Fifty-six percent of those not yet retired are rethinking their retirement plans, including how much money they will need or when they plan to retire.

The findings can’t be ignored — they illustrate the depth of the retirement income crisis facing the United States.

To learn more about the first Retirement Reset study, please visit the links below:

- Retirement Reset

- Retirement Reset Press Release

- Retirement Reset Report

- Retirement Research Research Summary

- Retirement Reset Fact Sheet

To learn more about the second Retirement Reset study, please visit the links below:

- Retirement Reset Wave 2

- Retirement Reset Wave 2 Press Release

- Retirement Reset Wave 2 Report

- Retirement Reset Wave 2 Fact Sheet

- Retirement Reset Wave 2 Tracker

To learn more about the third Retirement Reset study, please visit the links below: