Protected Lifetime Income Index Study

5 minute read

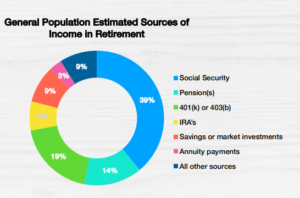

The Alliance for Lifetime Income’s Protected Income Index Study research program, conducted annually from 2018 to 2020, tracked the level of protected and unprotected households in the United States. It provides valuable insights into Americans’ attitudes and behaviors around retirement-income planning.

PLI Wave 1 – October 4, 2018

The Alliance for Lifetime Income’s 2018 Protected Lifetime Income Study found two-thirds of today’s pre-retirees haven’t taken the critical step of calculating their expected retirement expenses, while half of retirees admit they have not determined their expenses before they retired.

PLI Wave 3 – October 26, 2020

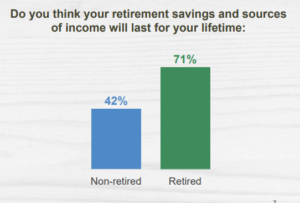

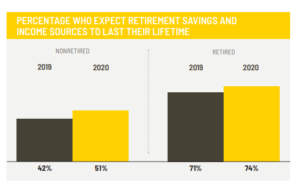

The Alliance for Lifetime Income’s 2020 Protected Lifetime Income Study found that Americans are more anxious now about their retirement savings, with nearly half (49%) of pre-retirees concerned their retirement savings and sources of retirement income won’t last through retirement. As a result, people are looking for protected income from annuities to ensure they have a reliable stream of income they can count on in retirement.

“No American should face the prospect of running out of money in retirement, and while this year’s study highlights measurable progress toward that goal, there is still much work to be done.”

JEAN STATLER CEO OF THE ALLIANCE FOR LIFETIME INCOME

To learn more about the findings from the 2018 PLI study, visit the links below:

- Press Release

- Research Findings

- The Alliance Protected Lifetime Income Index Study – Regional Summary

To learn more about the findings from the 2019 PLI study, visit the links below:

- Press Release

- Summary

- Research Findings

- Fact Sheet

- The Alliance Protected Lifetime Income Index Study – Texas Summary

- The Alliance Protected Lifetime Income Index Study – Florida Summary

To learn more about the findings from the 2020 PLI study, visit the links below: