THE CLOCK IS TICKING

8 minute read

Generation X and the challenge of retirement readiness

Abstract: This report provides an analysis of retirement readiness challenges among Americans approaching retirement age (45+) but not yet retired. It draws from the larger Protected Lifetime Income Index Study by the Alliance for Lifetime Income.

The Protected Lifetime Income Index Study

Retirement is the top financial concern of Americans, and for many, it is the issue they think about above all others.

The Protected Lifetime Income Index Study provides a comprehensive picture of Americans’ retirement readiness. This analysis is based on a national population survey conducted in October 2018 and sponsored by the Alliance for Lifetime Income. It highlights some of the important behavioral and emotional dimensions of the retirement readiness challenge, revealing key findings that support why many refer to this as a crisis:

- Half of Americans don’t believe their retirement income will last their lifetime.

- This confidence gap contributes to high rates of anxiety that cut across income and demographic groups.

- Just 38% of adult Americans have some source of protected lifetime income – either a pension or annuity that provides an assured income payment as long as someone lives.

- The confidence gap and the protection gap each increase with younger Americans because of the decline in access to pensions.

The Protected Lifetime Income Index Study shows noteworthy differences in outlook on retirement corresponding to people’s ages. Part of the difference can be attributed to life stage. Those at different stages of their lives face different near-term needs and longer-term prospects. One tipping point appears with the divide between those under 55 and over 55:

- Younger than 55: 65% are concerned retirement income will last their lifetime.

- Older than 55: 45% are concerned retirement income will last their lifetime.

It’s hard not to note the comparable difference between those over and under 55 years old in the proportion who have a pension. Over half (51%) of those older than 55 access this type of funding compared to less than a third (32%) of those 45–54 and a quarter of those (25%) under 45.

The Sandwich Generation: Understanding Pre-Retirees

This report extends the analysis of retirement readiness — and the financial circumstances associated with that — by examining the portion of the adult population who are old enough to begin seeing the approach of retirement (those at least 45 years old) but who have not yet retired. This group, made up of older Gen Xers and younger Boomers, is part of what has come to be called the sandwich generation, caught between responsibilities to parents and children as they do their own retirement preparation. To highlight the challenges in this time frame, this analysis contrasts those who are having more financial success versus those who are having less financial success as they prepare for retirement.

On the right path. These 45+ non-retirees represent just over one-third (36%) of the adult population between ages 25 and 74. In order to understand the readiness differences, this analysis compares those who have at least $75,000 in assets (in addition to a home) and those who don’t have that much. Why the division? Someone having success in preparing financially for retirement most often needs to start accumulating assets. While not a huge sum, $75,000 is a marker of progress against that goal.

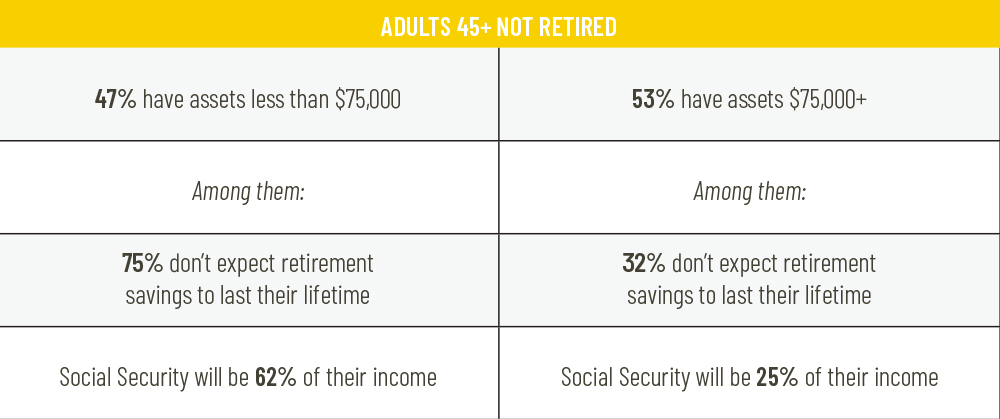

- A first key indicator of potential stress is how this $75,000 asset target divides the 45+ pre-retiree population. Nearly half (47%) fall below this target. By the numbers, their retirement saving is falling short.

- Retirement outlook is strongly associated with this financial division. Among those with less than $75,000 in assets, three-quarters (77%) don’t expect their retirement savings and income to last their lifetime, compared to only one-third (32%) of those with at least $75,000 in assets.

- The low-asset group anticipates being heavily dependent on Social Security for retirement income, expecting it to account for a median of 62% of their income. The higher-asset group expects Social Security to be just a quarter of their income on average, with the rest filled in by savings, pensions, annuities and other financial resources. To stress this point, those with lower assets now anticipate they will have substantially less to live on in retirement.

What are some of the characteristics distinguishing those on the path to building retirement income from the others?

We look below at four sets of traits: income, personal preparation, current financial circumstances and emotional outlook on retirement

The income effect. Two characteristics top the list of tangible drivers behind savings for retirement income: current income and pensions.

- Higher-asset households have substantially higher incomes on average. Only two in ten (18%) higher-asset house holds have current annual incomes less than $75,000, and only 3% have annual incomes less than $35,000. By contrast, seven in ten (69%) low-asset households have incomes under $75,000 annually and nearly a third (31%) have annual incomes less than $35,000.

- Looking at the data for low-income households reinforces just how difficult it is for these units to accumulate significant assets. Just one quarter (26%) of those with annual incomes under $75,000 have been able to accumulate $75,000 or more in assets, while only one-tenth (10%) of those with less than $35,000 in annual income have done so.

- Even though pension ownership is related to future income, it also shows a large impact on current assets. Half of high-asset households (50%) hold a pension compared to just one in five (20%) of those with low assets.

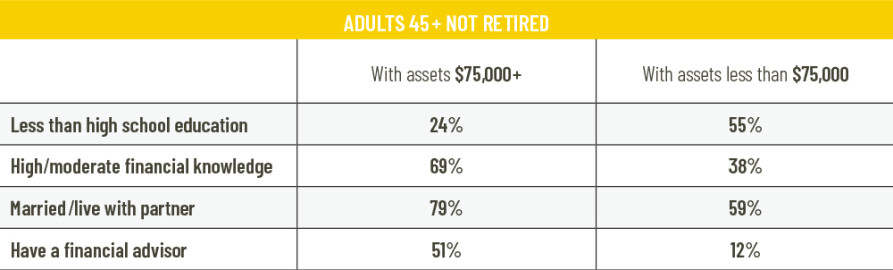

Personal preparation and support. Americans approach the pre-retirement stage of life with widely different levels of personal preparation and support.

- A much larger proportion of lower-asset households also have lower levels of educational attainment.

- Generally, lower-asset households recognize that they lack financial knowledge.

- They also are less likely to have a partner to turn to.

- Few have a professional source of financial advice.

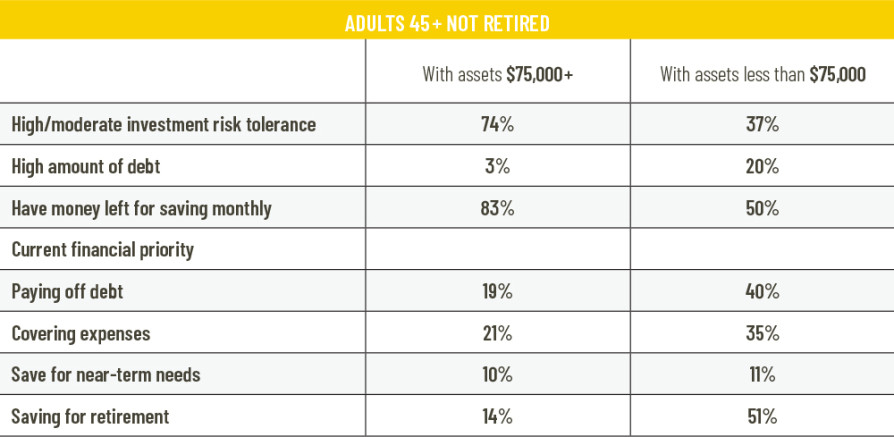

Current financial situation. Income and asset levels alone do not fully capture the diversity of personal financial circumstances. The financial status of an individual today not only reflects past progress; it also affects potential performance when saving for tomorrow. Those 45+ non-retirees who have lower assets accumulated so far are slated to fall farther behind as they also:

- Are much less likely to characterize their household financial situation today as good and much more likely to describe it as bad;

- Are much more likely to be having cash flow problems — just half indicate that they are able to save anything on a month-to-month basis;

- Have moderate- to high-debt levels, and are much more likely than those who have accumulated assets to be carrying high debt-levels; and

- Consequently are unable to prioritize saving for retirement.

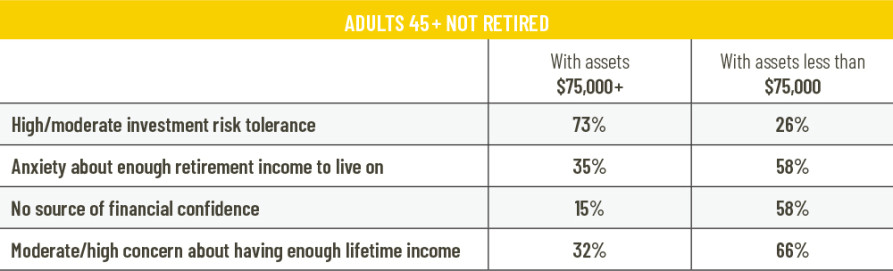

The emotional toll. The combined effect of these factors is made more challenging with the emotional toll they take on pre-retirees. This emotional impact is manifested in a number of ways, as shown by the comparison of lower-asset to higher-asset 45+ non-retirees.

- The lower-asset group tends to have lower financial risk tolerance or doesn’t even engage in thinking about risk because of their absence of resources. This stands in contrast to most investors who — regardless of their personal taste for investment risk — recognize that most investing requires judgments about risk.

- In addition to their low confidence about their retirement income lasting their lifetime, lower-asset households are more anxious that they won’t have enough to live on during retirement; in effect, anticipating a decline in living standard during this time.

- Lower-asset households have few sources of financial confidence. Considering plans, advice, pensions, annuities or accumulated assets, this group is most likely to say that none of the above give them confidence about their retirement prospects.

- Conversely, lower-asset households see these gaps as sources of concern that negatively affect their retirement confidence.

Not all rosy on the other side. The factors that have helped half of the sandwich generation accumulate at least some assets have benefitted their financial and emotional well-being. But crossing that threshold isn’t a guarantee of positive outcomes. It is noteworthy that even among those who have accumulated at least $75,000 in assets, many fall short on multiple dimensions of retirement preparation:

- When asked about current financial priorities, two of five (40%) indicate that their top financial goal is either getting out of debt or keeping up with expenses— hardly a sign of financial comfort.

- While most think their retirement income will last their lifetime, one-third (32%) do not, and a similar proportion (34%) acknowledge moderate to high anxiety about whether their savings can provide enough to live on in retirement.

- While a majority of the higher-asset group has a source of protected lifetime income – either a pension or an annuity – nearly half (47%) do not have that extra source of comfort.

- Even among those who enter their later pre-retirement years having crossed an initial savings threshold, there are further signs that many have similar problems as those who have little to no savings.

The Takeaway

Each generation faces its own unique circumstances related to retirement, and each has its own winners and losers in the preparation process. The current generation of pre-retirees — what we refer to here as the sandwich generation of older Gen Xers and younger Boomers — is the first in which a majority don’t have access to a pension and where many don’t even have access to an employer’s defined contributions plan.

As this report illustrates, the impact can be overwhelming.

Many thought leaders in government and the private sector recognize this problem and are working with counselors, technology tools, and other innovative market and policy solutions to support individuals on their personal journey to retirement confidence and security.

Those approaching retirement age without having been able to accumulate any significant assets face the most acute challenges. For low-income, low-asset households, there are multiple possible points of entry for interventions to improve prospects, beginning with better education and advice and including new policy structures to provide access to and encourage retirement savings. A hidden challenge is inspiring the personal confidence that gives an individual the energy to keep trying.

Those who have accumulated some assets can’t be left out of the equation in part because many have unique circumstances that convince them their retirement income is inadequate. While some may express confidence, they may not be taking the steps to provide assurance of a lifetime income. This challenge increases in importance as the number of people holding pensions (with their pooled-risk feature) declines. For many people with some resources but not high wealth, annuities are essentially the only tool that individuals can turn to for a reliable source of protected lifetime income.

About the Alliance for Lifetime Income:

The Alliance for Lifetime Income is a nonprofit 501(c)(6) organization formed and supported by some of the nation’s leading financial services organizations to create awareness and educate Americans about the importance of protected lifetime income. The Alliance is focused on helping educate Americans on the risks of outliving their income so they can enjoy their retirement lives. The Alliance provides consumers and financial professionals with the educational resources, tools and insights they can use to build plans for protected retirement income.

The 2018 Protected Lifetime Income Index study was conducted on behalf of The Alliance for Lifetime Income by Artemis Strategy Group, a Washington-based communications research firm, from September 11—19, 2018, among a national sample of 3,120 participants ages 25 to 74.

The interviews were conducted online, and the survey was balanced against the census to assure an appropriate age, gender, income, education, race, Hispanic ethnicity, and regional distribution.