Two-Thirds of Peak Baby Boomers Are Not Financially Prepared for Retirement

3 minute read

“America has never seen so many people reaching retirement age over a short period, and well over half of them will find it challenging to meet their needs through their retirements, let alone maintain their current standard of living. They lack the protected income that many older Boomers have from solid pensions or higher savings.”

Robert J. Shapiro, former Under Secretary of Commerce for Economic Affairs

In a definitive study commissioned by the ALI Retirement Income Institute examining the economic impact of the greatest surge of retirement age Americans in U.S. history, the former Under Secretary of Commerce for Economic Affairs, Robert J. Shapiro, finds that a majority of Americans who will turn age 65 between 2024 and 2030 are not financially prepared for retirement.

Executive Summary | Economic Impact Study Report | Press Release

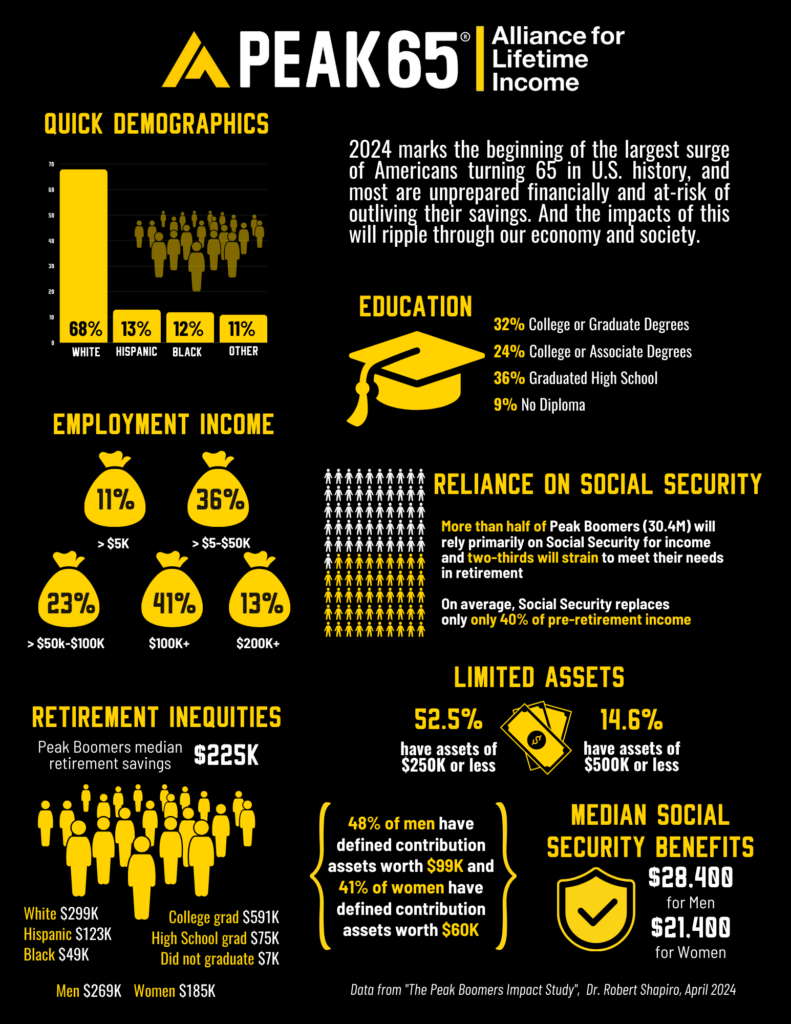

Based on their assets and their likelihood of living up to 20 or more years in retirement, two-thirds of Peak Boomers will be challenged to maintain their lifestyles in retirement. More than half (52.5%) have assets of $250,000 or less, making it likely that they will run through their savings and have to rely mainly on Social Security for income. Another 14.6% have assets of $500,000 or less, so nearly two-thirds will strain to meet their needs in retirement. On average, Social Security is intended to replace about 40% of a person’s annual pre-retirement income, according to the Social Security Administration.

WATCH Peak65 Economic Impact forum

On April 18, Robert Shapiro and Jason Fichtner released the findings at the National Press Club, followed by a special panel featuring Jean Chatzky: Education Fellow, Retirement Income Institute & CEO, HerMoney; Caroline Feeney: EVP & CEO, U.S. Businesses, Prudential Financial; Ellen G. Cooper: Chairman, President & CEO, Lincoln Financial Group; Bryan Pinsky: President, Individual Retirement, Corebridge Financial; William Gale: Chair, Federal Economic Policy, Brookings Institution; and Shai Akabas: Chair, Federal Economic Policy, Brookings Institution, Executive Director, Economic Policy Program, Bipartisan Policy Center.